2017 Which 1040 Tax Form.do I Use Self Employed

Form 8915-F wont generate because its not required. Most self-employed individuals will need to pay self-employment tax comprised of social security and Medicare taxes if their income net earnings from self-employment is 400 or more.

Fake Tax Return Refund Yearly Income Gross Net Profit Loss Signed Verification Proof Irs Statement Mortgage Loans Validati Tax Return Tax Fake

You only need the 2020 8915-E info for your 2021 tax return.

. TurboTax Live en español. You can always use Form 1040 regardless of whether you qualify to use Form 1040A or 1040EZ. Each forms instructions provide the rules for which form to use.

Instead you must report your self-employment income on Schedule C Form 1040 to report income or loss from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit. For expenses less than 5000 use Schedule C-EZ. No Matter What Your Tax Situation Is TurboTax Has You Covered.

Self-employed taxpayers must file a Schedule C Profit or Loss from Business or Schedule C-EZ Net Profit from Business with their Form 1040. Forms 1040A and 1040EZ are just simplified. For those making a profit self-employment and income tax may need to be paid.

While your tax return is more complicated as a freelancer you gain flexibility and autonomy and a greater degree of control over the work you do. Mailing address for where to mail your forms. IRS Use OnlyDo not write or staple in this space.

A 2017 tax return can only be printed and mailed it cannot be e-filed. Individual Income Tax Return. The mailing address is listed on the 1040 Form for any given tax year.

Tax forms included with TurboTax. As a contractor with a 1099-MISC however youre responsible for the full 153 of the self-employment tax and you can deduct the one half of the self-employment tax on your personal tax return Form 1040. 2017 tax table to use with Form 1040.

As an individual taxpayer you can file your tax return with IRS Form 1040 1040A or 1040EZ depending on your tax situation. Publication 225 Farmers Tax Guide. Our easy to use DIY tax software is designed to help you get your maximum refund.

You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year. Weve got you covered. Individual taxpayers in the United States use IRS Form 1040 when filing their federal income taxes.

How do you know which form you should use. Enter the amount from your Form 8915-E line 4 column b and select Continue. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits.

This public-private partnership between the IRS and tax software providers makes approximately a. You can print fill-in and mail. If your adjustedg rossincome was 66000or lessin 2017 you can use free tax software to prepare and e- le your tax return.

The SE tax is a self-employed individuals equivalent of the payroll taxes withheld by employers. The IRS will begin processing paper and electronically filed federal income tax forms on January 29 2018. For the year Jan.

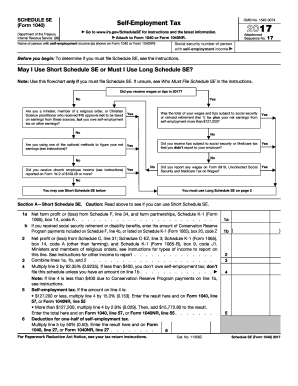

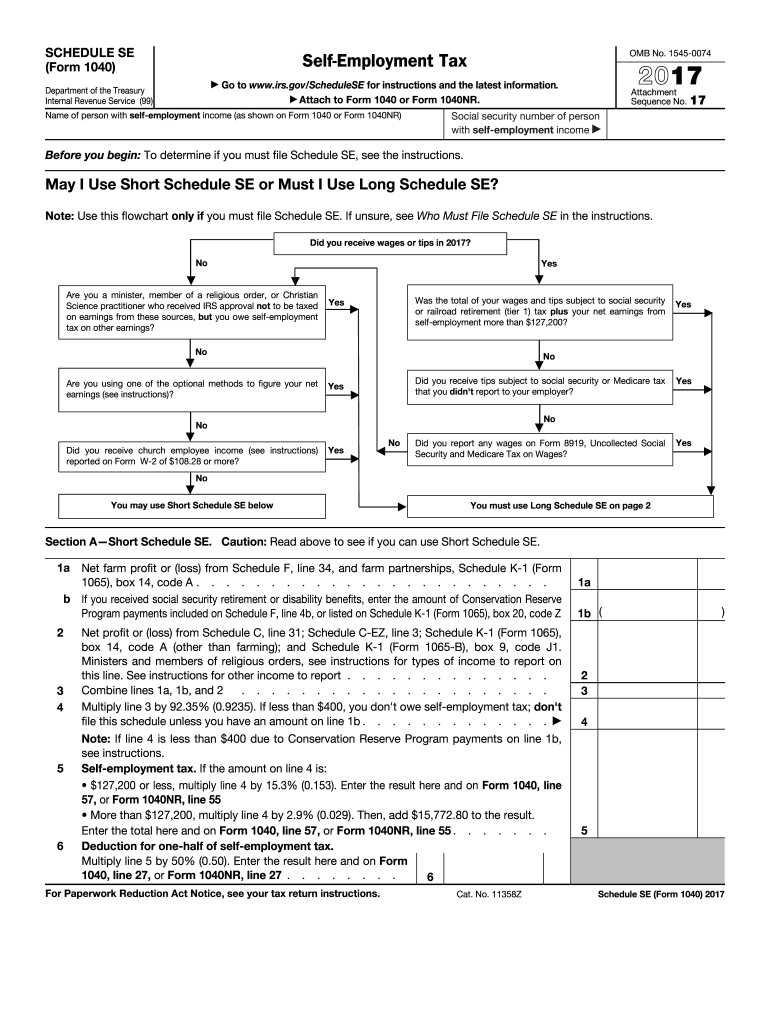

Attach to Form 1040 or Form 1040NR. Select your state s and click on any of the state form links and complete sign the form. Form 1040 Department of the TreasuryInternal Revenue Service 99 US.

For instructions and the latest information. Select to complete Qualified 2020 Disaster Distribution From Retirement Plans other than IRAs Go back to the 8915-E section in your 2020 return. Ad Freelancer independent contractor or just working a side gig.

The schedule also helps you calculate the deduction youll take for the one. Publication 15-A Employers Supplemental Tax Guide PDF. You can use the 1040 to report all types of income deductions and credits.

The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. 2017 Schedule SE Form 1040 SCHEDULE SE Form 1040 Department of the Treasury Internal Revenue Service 99 Self-Employment Tax. Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment.

The form comes in three varieties --. Once you determine the net profit from all your businesses youre ready to compute your SE tax using IRS Schedule SE IRS Form 1040 Self-Employment Tax. 31 2017 or other tax year beginning 2017 ending 20 See separate instructions.

Publication 334 Tax Guide for Small Business For Individuals Who Use Schedule C Publication 463 Travel Gift and Car Expenses. The form will walk you through the calculation for the SE tax since different lines are used for different types of income. When done select one of the save options given.

In order to file a 2017 IRS Tax Return click on any of the form links below. Use Schedule SE Form 1040 Self-Employment Tax to figure the tax due. Self-employment income Income from sale of property If you cannot use form 1040EZ or Form 1040A you probably need a Form 1040.

Use Free File Fillable Forms. Your first name and initial. TurboTax security and fraud protection.

How do you know if you are eligible for a 1040a or 1040ez. Ad Uncover Hidden And Industry-Specific Deductions To Keep Every Dollar You Deserve. Use Schedule SE Self-Employment Tax to calculate the taxes and report on Form 1040 Schedule 4 Other Taxes.

Coronavirus and your taxes. Visit our Form 1040 page to view a complete list of federal income tax forms including the above 2017 Form 1040 Instructions booklet. Ad Download or Email IRS 1040sse More Fillable Forms Register and Subscribe Now.

If your net profit is greater than 400 you must pay SE Self-employment taxes. Youll figure your self-employment tax on Schedule SE. You can complete and sign the forms online.

2017 Form Irs 1040 Schedule Se Fill Online Printable Fillable Blank Pdffiller

Fillable Form 1040 Schedule C Ez 2017 Tax Guide Power Of Attorney Form Schedule

2017 Form Irs 1040 Schedule Se Fill Online Printable Fillable Blank Pdffiller

No comments for "2017 Which 1040 Tax Form.do I Use Self Employed"

Post a Comment